Housing Will Remain Hot

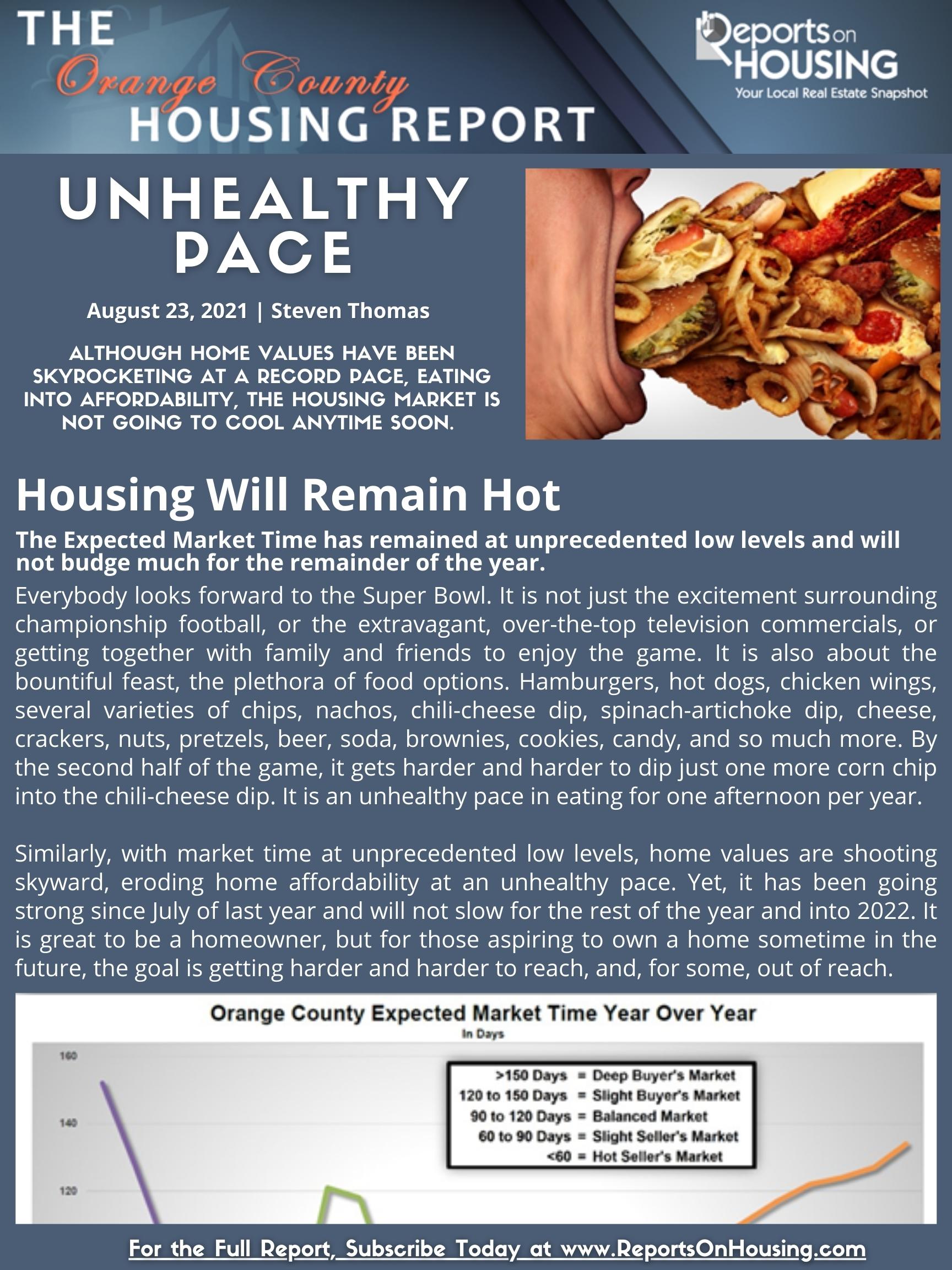

The Expected Market Time has remained at unprecedented low levels and will not budge much for the remainder of the year.

It is important to clear the air and explain that just because housing is appreciating at an unhealthy rate, it does not mean that a bubble is inflating or that housing will inevitably crash. There is absolutely nothing in the charts and data that statistically support that conclusion. Instead, housing is becoming unattainable for more and more first-time homebuyers and renters.

In looking at the Expected Market Time (the amount of time between hammering in the FOR-SALE sign to opening escrow), it has remained below 45-days since the end of July 2020. Anything below 45-days indicates an insane, scorching hot housing market where buyers are tripping over themselves to be the first to see a home that just hit the market, multiple offers is the norm, and homes are selling above their list prices.

In fact, according to the California Association of REALTORS®, 70% of all closed sales in the month of July sold above their asking prices.

It has been 10-consecutive months that more than 50% of closed sales sold above their asking price. Today’s 28-day Expected Market Time is far below that 45-day threshold; the lower the market time, the hotter the market.

Soaring home values is not healthy and ultimately will limit the number of buyers able to purchase. While affordability is not yet an issue due to record low rates (affordability factors prices, rates, and incomes), eventually values in Orange County will climb to a point where the housing market will slow as more and more buyers stop their search due to monthly payments that are just out of reach. When that occurs depends upon how high values climb, any eventual rise in rates, and the limits to rising incomes. For now, it is not an issue, and the current pace will not change for the rest of 2021.

Click on the image below the Read the Orange County Housing Report.